Laka is a community based Insurtech brand. In a nut shell ‘Laka uses a people-powered insurance subscription to make insurance fair, not fixed. Each month’s claims are spread amongst a collective of cyclists…’. Their growth since they were founded in 2017 has be impressive with an enterprise valuation of $74m and a recent round of funding of €7.6m, as well as now moving towards making acquisitions (Oct 2023).

There has always been a mismatch between traditional insurance companies and their consumers. Insurance is an adversarial business with too many insurers being directly adversarial with their customers and especially where claims are concerned. There has been a trend by some of the larger players in the category to resolve some of the issues, for example Direct Line has become renowned for a focus on a seamless and high value claims experience. However, the likes of Laka, Lemonade and Marshmallow, among others are challenging the conventions with new disruptive business models and customer first approaches.

The Business Model

The Laka business model is simple and has a powerful community-based approach. In essence a 'collective' of cyclists that are in it together. If my premium goes up from one month to the next, then I know it's because a fellow cyclist has had some bad luck. Quite frankly that makes me feel a lot better about it. However, my insurance premium can also go down and I feel pretty good about that too. Another aspect to this community-based dynamic is that it is highly likely that false claims are lower. The reason for this is that with any false claim you would simply be upping your fellow cycling mates’ premiums and doing them out of a few quid. How could you ride with your cycling buddies with that on your conscience.

Customer First Approach

The innovative and disruptive business model aside there are some other things that Laka just gets right including a customer first approach. They’ve really thought about customers and put a premium on a great customer proposition. They’ve taken the time to listen and understand cyclists and the cultural aspects of being a cyclist. It means that they connect on a much more relevant, interesting, and deeper level than other insurance brands could hope to achieve.

Transparency

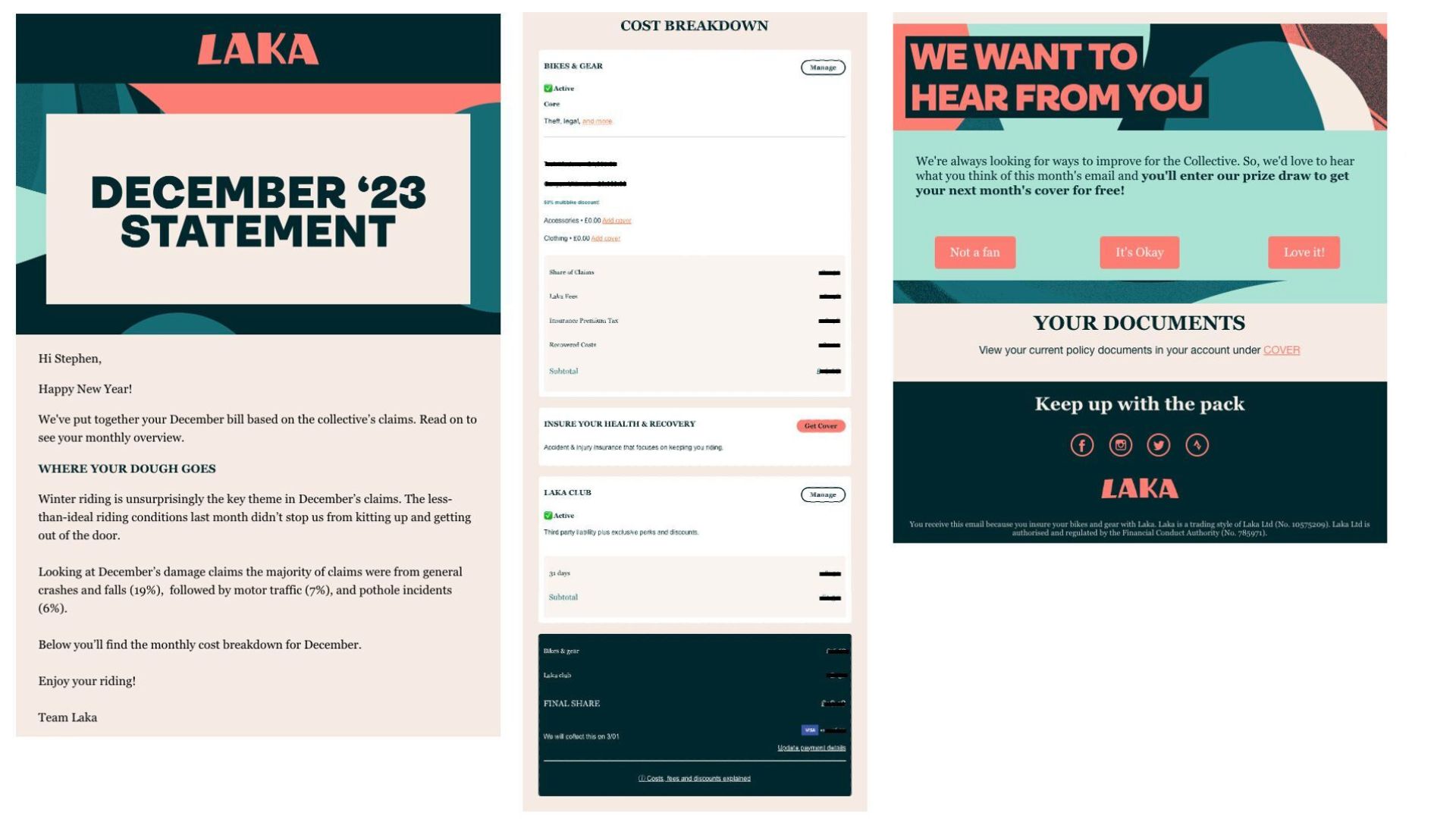

The level of transparency they offer is outstanding. Every element of my premium is broken down in detail in my monthly statement. I can see exactly what I’m paying for. And it makes me feel a lot better about the 10% profit that they make on my premium each month. I don’t begrudge them that modest amount at all. Along with building trust and loyalty through transparency they also focus on openness. They crave feedback from customers and use it to offer a better core service and provide added value.

Branding

The brand has also been thought about carefully with the proposition, design and tone of voice speaking to you not at you. It feels like they’re right there with you rather than in a high-rise office in central London looking down on you. Down to earth, no nonsense and friendly just like one of your cycling mates.

A Sense they Care

Finally, you just get a sense that they care. An insurance brand that you feel genuinely cares about you, who’d have thought it. A great example of this was them actively offering a downgrade on the insurance product and putting me on a cheaper premium. I’ve not experienced that from any other insurance provider ever.

So, for me Laka is a great example of a brand that’s getting several things right in a category that tends to get a lot of things wrong. They’re customer first approach takes them beyond the category conventions and alongside transparency, openness, tone of voice and sense of care builds long term trust and loyalty with their customers.

I never thought that I’d feel a genuine positive affinity to an insurance brand, however, my experience of Laka has been a pleasant surprise. Dare I say they have become a brand that I love. Something I’m not often inclined to say about any brand let alone an insurance provider.

Share this article